Peter Jones, Chairman, PSE Consulting

Proposition

With the coming of Instant Payments, many are questioning the capability of the EU cards rails to offer a competing real time service. Current EU acquiring platforms are predominantly dual message, batch based, slow and costly. Today clearing and settlement takes 36 hours for International Card Scheme (ICS) transactions. Several of the best performing national debit schemes only achieve 12 hours. Increasingly card’s anachronistic Authorisation, Clearing and Settlement (ACS) model is being questioned as very low-cost; Credit Transfer (CT) services “go live.” Batch processing is already limiting card issuers ability to respond and match Instant CT’s immediacy. Many predict that failure to implement real time Single Message (SMS) processing could severely damage the growth of Europe’s cards business.

Background

“Dual” messaging is a hangover from the simple credit card processes developed in the 1960’s when merchants used voice authorisation and paper vouchers all settled by cheque end of the month. As new processes were introduced in the late 70’s this “Dual” process was copied. Authorisations and paper were transferred into electronic formats, but the early structures and processes remained. By the end of 70’s the ICS introduced their worldwide networks which supported dual message, first with an authorisation followed by a second end of day clearing record passed to the scheme networks for settlement. New batch acquiring components were added during the late 80’s, but architectures and processes have remained much the same ever since!

When ATM platforms were developed in the 70’s, SMS processing was introduced. This enabled authorisation and clearing record generation to occur simultaneously allowing the card holder account to be updated immediately and enabled interbank settlement at end of day. Logic would have argued that as the Debit Card was introduced in the late 80’s/early 90’s processing should have followed the simple ATM/SMS model. A few far-sighted EU schemes (Denmark, Norway, Spain and Portugal) went for SMS. However, SMS’s global introduction was constrained by the widespread implementation of dual batch processes for credit and ICS debit. Most acquirers therefore adopted dual. Thus, an opportunity for real time was missed.

The Current Challenge

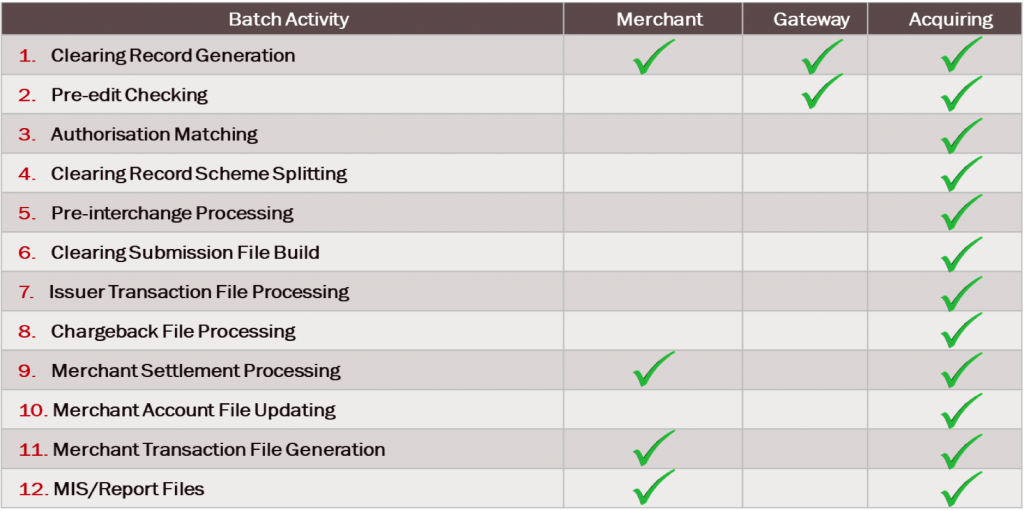

So, how easy would it be to switch to SMS 25 years on? It would be an understatement to say current ACS and acquiring processes are complex. A typical ICS credit and debit acquiring platform operates 20+ major batch sub-systems. Merchants and gateways submit end of day batch clearing files which creates a critical bottleneck, particularly on peak days. The day’s authorisations are matched, and anomalies identified, complex batch edits and pre-interchange processes are followed before batch submission to the card schemes, who similarly sort and clear in batch mode.

Many subsidiary activities are also batch, including merchant account updates, settlement files and chargeback processing. All these processes have to be completed overnight to meet local debit and International Card Scheme submission deadlines.

So current ACS and acquiring processes are complex, take up to 36 hours to settle, reduce liquidity and need a heavyweight clerical back-office team to support. For traditional acquirers developing an online SMS based acquiring platform is potentially a high-cost and risk investment. Batch processes have to be rewritten to support clearing record generation in-flight and the back-office operational model realigned.

However, there are obvious benefits including significant process simplification. Intraday merchant settlement is also an attractive new product offer. Acquirer liquidity may be improved, elements of fraud and longer-term support costs reduced. But acquirers will still need to support both Dual and SMS for many years, because many merchants have also built their systems around this batch approach. Software platform providers can help deliver solutions as can domestic and international card schemes, but for many acquirers a business case for real time SMS is difficult to construct.

The Future

Despite the modest returns many believe real time SMS is a “Must Have.” New competition from the very low-cost Instant CT and the planned PSD2 PIPSP services cannot be ignored. Both have potential to significantly damage the cards business model.

Will real time ACS be realised for cards and enable the acquiring batch “pinchpoint” to be removed? Similar, strategic cards change have happened before. EMV/PIN is a good example, and more recently the Secure Remote Commerce initiative, both driven by public pressure to reduce crime and fraud. However, the business case for building real-time rails for ACS lacks such a clear objective. Migration to SMS is part of a cards business collective repositioning exercise, and there is no agreed forum within which this strategy can be built.

One final thought, to the break the impasse. A key missing business case component is a new revenue stream to service the investment. If the cards business matches the Instant CT with a new Instant real-time Card offer this could generate sufficient revenues to fund ACS migration to SMS.