Members

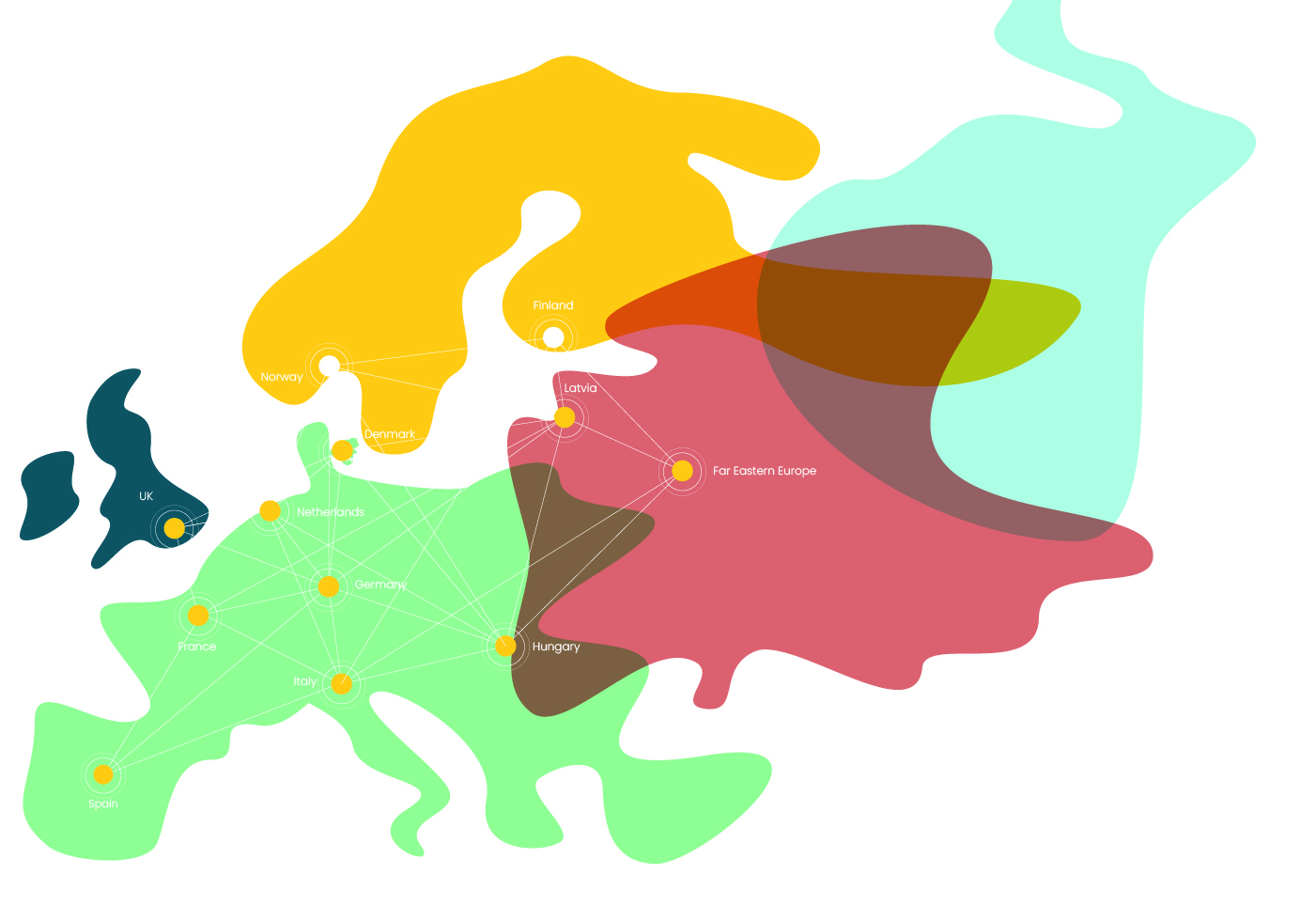

EPCA’s operations are split into 8 areas across Europe.

Click on the map to find out more about each member and their areas of specialisation or select from the dropdown below.

Marco Fava, Managing Director

Andrea Bernardo, Senior Advisor

Ronald Te Velde, Managing Partner

Eppo Heemstra, Management Consultant

Emmanuel Caron, Practice Manager

Nicolas Miart, Managing Director

Zsomber Imre, Co-Founder

Hugo Godschalk, CEO and EPCA Founder

Ludmila Berzina, Co-Founder

Indra Kesane Senior Consultant, Board Member

Chris Jones, Managing Director

Peter Jones, Chairman and EPCA Founder

Morten Mansrud Managing Director and Senior Advisor

Mikko Rieger, Managing Partner

Alexey Martsinkovsky

Luis Peiro, Partner

Jaime Pérez Guitián, Partner

Overview:

- CleverAdvice was established in 2001, is based in Milan and has been an EPCA member since 2008

- The company is a leading independent professional management advisory services firm, specialising in the payments and banking industries

- CleverAdvice brings together a team of experts in strategy, market analysis and research, technology and regulatory issues with ability to provide a comprehensive support through innovative, effective and actionable recommendations

- The company supports Italian and International businesses – established players and newcomers – and private equity funds

Our Specialisation:

- Develop consumer and commercial payment products and services

- Structure digital onboarding processes and User experience for issuing and acquiring payments and banking products/services

- Design Open Banking-specific use-cases, process mapping, size of opportunity and operational recommendations

Our Mission:

- To provide our clients with best in class strategic direction, tailor-made research and business insights based on our 20 years in providing advisory services

- To be a trusted partner, advisor and catalyst by promoting innovative thinking and challenging goals to ensure that our clients always stay one step ahead of the competition

- To identify and size business opportunities and provide actionable recommendations aimed at achieving short term time-to-market, accelerating sales growth and delivering high value to investors

Contact details

CleverAdviceVia Ferrante Aporti 34

20125 Milano, Italy

Overview:

- Connective Payments was established in 2014 and has offices in Amsterdam in the Netherlands. The company is lead by an Executive team of Ronald te Velde and Eppo Heemstra

- The company advises and provides services to organisations in the payments value chain, with the objectives to make them more successful.

- Connective Payments is creating value for their clients’ business, based on profound expertise of the payment value chain and a vast industry network, They believe that sustainable results can only be reached through a process of co-creation.

Our Specialisation:

- Business development: strategic advise, roadmap, execution, new business model development

- Product development: (new) market research, new propositions, subscription and marketplace models

- Business optimisation: PSP selection and optimisation, vendor selection, digitisation, automated customer due diligence

- Management: program management, interim management, scrum master, product owner etc.

- Compliance, risk, legal, licensing: development of legal frameworks, licensing projects, compliance programs

Our Mission:

- To share our collective passion for payments by helping clients create value for their business

- To bring together the right experience to help our clients grow their companies and improve profitability

- To build a network which will shape alliances and create beneficial and rewarding client and vendor relationships

- Our core values in delivering assignments to our clients are: customer centricity, team effort with our clients, focus on time delivery, accountability, impartially and independence.

Contact details

Connective Payments Pastorielaan 1aHoogland

3838 EX, The Netherlands

Overview:

- Galitt was founded in 1990 and became part of the Sopra Steria Group in 2017. The company has its main offices in Paris

- Managed by Rémi GITZINGER, Executive Vice President, Galitt Payment Consulting business unit brings together a multidisciplinary team who has delivered assignments to all French market players in Retail banking and Payments

- Galitt offer a wide array of payments advisory services which includes business and regulatory consulting, strategy and operational marketing, payments architecture design, audits and security assessments. Galitt also offers project management services, operation of closed-loop payment schemes as well as automated testing tool suites.

Our Specialisation:

- Researching country EU market profiles including payment chain players and roles, business models and local regulation specifics

- Opportunity assessments, business plans/modelling, market studies, benchmarks – including qualitative analysis

- Impact assessments of new Regulations, Technology and Fraud and Security issues

- Regulatory licenses: application assistance for French ACPR authorisation or exemption, or to passport from or to France

- Strategic and sales partnership identification/management

Our Mission:

- Helping our clients address the changing payments market challenges and to speedily deliver solutions to the most complex issues.

- Delivering innovative business and technology concepts based on structured methodologies to delight our clients and add value and long term profits to their business.

- Setting up resource teams to provide and cover all technology skills required for the complete lifecycle of a payment development project.

Contact details

Practice Manager, Galitt Payment Consulting17, route de la Reine

F-92100 BOULOGNE

Overview:

- Invendor Advisory Services is based in Budapest, Hungary and was founded in by Zsomber Imre.

- The company offers a wide range of consulting and advisory services within the Hungarian and CEE Markets for corporate payments clients, banks, gateways, issuers and acquirers

- The company supports strategic buyers and private equity clients providing “buy and sell” side M&A advice. Invendor has built good working connections with the major EU capital markets

- Invendor also develops best practices processes for clients designed to optimise assets, resources and reduce the costs of operation

Our Specialisation:

- Developing M&A-driven international market entry strategies and plans for payment service providers and Fintech companies, opening doors to the Central and Eastern European markets.

- Developing go-to-market acceleration and internationalisation plans and business cases for Fintechs and financial institutions.

- Assisting banks, telcos and payments players in developing solutions for digital transformation and regulatory change as part of strategic plans for growth.

Our Mission:

- We help Fintech and start-up companies develop innovation and new proposition strategies plans and business case

- Invendor also helps established larger corporates meet the challenges of competition and review and reposition their products and services

- Invendor also promotes entrepreneurship and helps new businesses realise ideas through our unique payments business unique knowledge sharing ecosystem

- The company also provides tailored payments business training and sandbox innovation methodologies

- Our consultants are seasoned top-tier advisors, speak several languages and have hands-on experience in banking, payments, IT security, M&A and compliance

Contact details

Mr Zsomber ImreSemmelweis u. 3,

Budapest, 1052

Hungary

Overview:

- PaySys was established in 1993, by CEO Dr. Hugo Godschalk and is based in Frankfurt, Germany. PaySys is a founder member of the EPCA.

- The company’s focus is on providing advisory services to German and international companies: These include market analysis, benchmarking, business case analysis as well as providing expert support for M&A and Due Diligence.

- Paysys are well known for their periodic publications including: German card market statistics (yearly update) and the PaySys-Report (10 issues p.a.)

- The company is the advisor and coordinator to the IK special Interest Card Businesses Group with 20 member companies as well as the German Prepaid Association PVD.

- Dr. Hugo Godschalk is also a regular blogger on payment issues (www.paytechlaw.com)

Our Specialisation:

- Payment regulatory and legal issues

(implementation of PSD2, EMD2 and other EU payment related directives) - Card market analysis and statistics

(issuing, acquiring, alternative payments methods) - E-Money and virtual currencies

(incl. complementary currencies)

Our Mission:

- PaySys’ objective is to empower its business clients by delivering high quality advisory services which add significant value to its clients and their customers.

- PaySys supports clients assignments with a team of highly experienced dedicated specialists who have extensive and detailed understanding of the German payments market, the players, regulation, compliance, operational processes and security.

- A key focus is to supply the German market with accurate indepth payments statistics which will form firm foundations for planning and forecasting

Contact details

Hugo GodschalkIm Uhrig 7

60433 Frankfurt am Main

Germany

Overview:

- Vedicard is a payments and banking consulting company established in 2012 and based in Riga, Latvia. The company is lead by co-founders, Ludmila Berzina, Indra Kesane and Girts Aizstrauts

- Vedicard’s advisory services cover a wide range from traditional payment cards and banking solutions to emerging new payment methods including mobile, cloud and instant payments as well as new product innovation.

- Vedicard’s team of payments consultants offer high quality advice on business and technology strategies, conduct market research, advise on regulatory impacts, as well as managing projects, conducting testing/providing implementation support and training

- Vedicard’s customers include banks, merchants, Electronic Money Institutions (EMIs), processors, gateways as well as Fintech start-ups

Our Specialisation:

- Managing and planning complex large technology projects and their implementation

- Conducting payments innovation and technology research into the Nordic and Baltic markets

- Developing Target Operating Models, governance processes and procedures for large scale payments businesses

- Resourcing the end to end payments development pipeline – from business systems analysis and IT product specification through development to testing, certification, piloting and implementation

Our Mission:

- To share with our clients our payment industry passion and our expertise in finding new payments solutions that add significant value.

- To be a first choice trusted consultancy and long-term partner to the financial sector

- To provide “best in class” advice and expertise to all payment industry sectors and players

- To deliver our advice independently with integrity and thoroughness

- To delight our clients by delivering “out of the box” innovation concepts that generate new revenues and profits

Contact details

Skolas street 21Riga LV 1010

Latvia

Overview:

- PSE Consulting (Payment Systems Europe) was founded in 1991 in London, UK by Peter Jones (Chairman). The company’s Managing Director is Chris Jones.

- PSE is a founder member of the EPCA and also is an Associate Member of UK Finance.

- PSE Consulting has 30 years experience in delivering advisory assignments to Europe’s banks, merchants, processors card schemes, gateways, issuers and acquirers.

- The company is well known within the UK and across the EU for its focus on payments acceptance innovation and for its bi-annual Merchant Acquiring and Gateway Conferences

Our Specialisation:

- C-level strategic payments studies with a particular focus on acceptance, acquiring and processing.

- Innovation assignments with a particular emphasis on gateways, mobile payments and alternative payments.

- M&A support to Strategic Buyers, Private Equity and Venture Capital conducting market assessments, business operational, technical, due diligence and financial assessments.

- Multi-country EU and ROW research into all aspects of payments drawing on extensive databases and detailed market models.

Our Mission:

- To provide independent, totally impartial business operational and technical consulting advice to our clients across the EU and the Rest of the World.

- To recruit and resource assignments using highly experienced consultants, who have extensive hands-on backgrounds in managing payments business, accountancy and financial modelling

- To work closely with our partner companies in the EU, USA, APAC, and MEA to deliver “best in class” payments research and advisory services to our clients.

- To become the “Go To” recognised observer of the EU payments market and to provide opinion leadership on market developments and trends.

Contact details

Chris Jones 4th Floor93 Great Suffolk St

London SE1 0BX United Kingdom

Overview:

- Avantio founded its advisory and consulting business in 2020 in Oslo, Norway. Morten Mansrud, is the company’s Managing Director and Chairman, with more than 30 years of experience from the financial services, fintech and the payment industry.

- The company have high competence from the issuing, and acquiring business, core banking, and the entire payment eco-system.

- Avantio have many years experience from working with large and medium-sized Nordic and international banks, retailers, fintech, card networks, service providers and processors.

Our Specialisation:

- In-depth knowledge and experience from business development, strategy, market research, business and requirements analysis, product concept developmentand projects.

- High competence and good understanding of the card and payment landscape, value chains, technology and the new payment eco-system driven by Fintech and open banking.

- The founder of Avantio, Morten Mansrud, has gain extensive experience from positions at industry-leading companies and is well known within in the payment industry across the Nordic countries and Internationally.

Our Mission:

- To provide a team of highly experienced professionals offering advisory and consulting services to help our clients to achieve their market, business and project goals.

- To help your clients understand the market, trends and changes, choice of partners, product development, risk assessments and growth.

- To collaborate with the company’s key partners where this creates added value for our customers

Overview:

Mikko Rieger who held senior mgmt positions both in the Nets Group as well as at Enfuce founded rieger.fi as a consultancy focusing on payments in the fall of 2019. The firm is registered in Helsinki, and is active throughout the Nordics and the DACH region. rieger.fi became an EPCA member in the fall of 2021.

Payments are in a renewal and expand beyond banks to all kind of businesses. Digitalization drives value from the transaction and card towards the user experience, identification and payment data. The cloud as technology platform and Fintechs drive operational and business models that rather quickly outgrow the established ones of traditional payment service providers and banks. rieger.fi along with all EPCA members understands where the puck is going in payments, and – as timing matters – approximately at which speed.

rieger.fi customers are issuers, larger merchants, payment institutions, payment technology and service providers and FinTech scale-ups.

The Specialization and Mission is still to be written but EPCA can add those in after.

Overview

Alexey Martsinkovsky, is an Independent Payment Consultant with over 25 years’ business and operational experience in the CIS and Eastern Asian markets. He has been a member of EPCA since 2012.

Alexey has worked extensively in the payments sector and has a detailed understanding of the business, operational and technical landscape, regulations, players and suppliers across the CIS and Eastern Asian geographics.

Over the years, he has established many contacts within the payments business and as a result has a unique insight into their operations.

Specialisation

Alexey provides a full package of payments go-to-market advisory services for foreign companies including:

Representation of companies interests to their potential clients, partners and suppliers

Making introductions and arranging meetings with key payments market contacts.

Helping in the preparation of bids and proposals.

Reviewing payments assets for potential investment or partnerships

Conducting niche payments market research and providing analysis and recommendations.

His Mission

Client commitment is his top priority. He always seeks to build relationships that make a positive difference to client’s business and add significant value to their customer propositions.

He can help large and small businesses identify new opportunities in new geographies that enable growth and expansion of client’s operations.

Contact details

Alexey Martsinkovsky

Overview

NALBA is a business consulting boutique with a strong focus on the financial sector, especially in Payments and Fintech.

Our differential value proposition consists in providing services based on top quality and professionalism with a high level of specialization and efficiency.

Nalba is led by professionals with extensive experience in top-level consulting firms (KPMG, PwC, Deloitte, Arthur D. Little, etc.) who share a common culture of excellence and client-orientation.

Nalba has a client portfolio composed of first-class financial institutions, Fintechs, retailers, travel specialists and payment services providers.

Specialisation

Nalba is a highly experienced and specialized company that offers management consulting services, from strategic thinking to operational issues, with particular focus on payments issuing and acceptance.

Strategy: our firm regularly supports from Tier 1 financial institutions to growing Fintechs in the design and execution of their mid/long term strategies (growth, internationalization, M&A, etc.)

Commercial improvement: support to increase reach and/or profitability (cross-selling, up-selling, loyalty, targeted commercial actions, pricing strategy, etc.)

Innovation & Digitalization: launch and improvement of digital solutions, outlook and trends in digital payments, UX diagnosis and optimization, etc.

Project management: payments related PMOs (both issuing and acceptance), C-level support and reporting, etc.

Mission

To provide independent, strategic, commercial, and operational consulting advice to our clients mainly across Iberia, the EU and Latin America.

To deliver top quality advice with much higher specialization and client orientation than larger generic consulting firms.

To support clients with a team of highly experienced and dedicated specialists who have extensive and detailed understanding of the payments market (competitive dynamics, players, regulation and processes).

Contact details

Calle Claudio Coello 16, 1o Izq 28001 Madrid Spain

Luis Peiro

Jaime Pérez Guitián

Luis De Miguel