By Peter Jones, PSE Consulting

Ever since Europe lost EuroPay in the late 1990s, payments stakeholders have been dismayed at the steady decline in their domestic debit card schemes and the gradual displacement of usage (now 70%) in markets where they remain. Several replacement plans have failed, either through lack of support or funding and regulatory concerns. Many have despaired over Europe’s inability to compete with American and Asian schemes and build a sovereign card payments network. Consequently, the European Payment Initiative (EPI) led by 20+ EU banks and processors must be strongly applauded as a bold and visionary concept to create a modern scheme and network for EU citizens, corporates and the financial sector.

Europe has a world class track record of delivering electronic payments process standardisation through the SEPA project. However, SEPA for Cards has struggled for many years to gain development traction. The EPI stakeholders have now recognised the need for a novel structure to deliver a new European scheme by forming a separate EPI company.

However, the scope of the EPI payments vision is very wide. Once requirements are specified the project delivery plan will be potentially very ambitious. Research into similar highly complex interbank initiatives that encountered difficulties in the past, shows uncomfortable parallels. The risks of lack of take up or an extended delivery timeframe and cost overruns are relatively high.

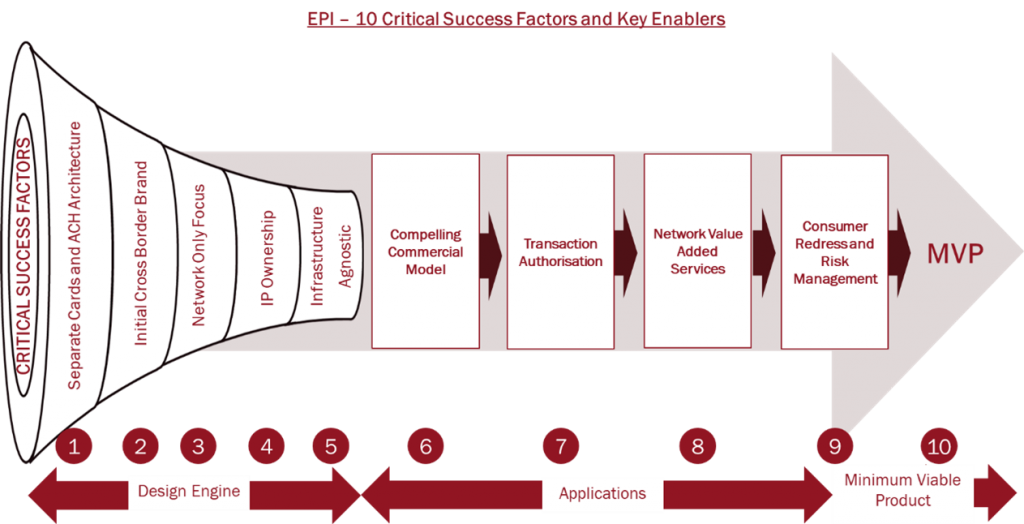

For these reasons, the nine members of the European Payments Consulting Association (EPCA) have developed a list of suggested Critical Success Factors (CSFs) and Key Enablers that can be considered as EPI design the architecture, define applications and agree a Minimum Viable Product (MVP) for the new EU scheme.

1. Separate Cards and ACH. As is well known, the retail cards business ‘technical and operational’ model is highly complex with multifeatured components built around tested security risk management and consumer redress frictionless processing principles developed over 50 years. Building an integrated Electronic Payments (ACH) and sophisticated modern Cards Architecture is a pioneering project yet to be undertaken by interbank scheme developers. The beguiling simplicity of starting within the SCTinst framework to deliver the front and middle components (with P2P as the first implementation) overlooks the potential to become a structure beset with compromises and workarounds. A strong case can be made for a clean sheet design for a pureplay cards architecture using electronic payments only for CSM clearing and settlement. It will be important to learn from the recent modern platforms developed in Russia, Turkey and several EU domestic markets.

2. Cross Border Brand. Since the 1990s, Europe has invested heavily in developing its remaining seven domestic debit card schemes. However, over time it has become increasingly apparent that co-badging with International Card Scheme (ICS) brands for cross border usage has contributed to issuer brand switching. Thus, logic argues that any new pan EU scheme should first focus on resolving the branding issue with a Phase 1 simple architecture. A key CSF would be to initially implement EPI as a cross border co-badge, allowing time for domestic scheme rules to be harmonised and postpone domestic brand absorption into the EPI scheme to a later release. The differences between the schemes in Belgium, Denmark, France, Italy, Portugal and Spain are modest. Germany’s unique Girocard scheme (already undergoing consolidation with other services) will be most impacted by EPI, will need significant change and will benefit from the extended timeframe.

3. Network Only Focus. The ICS have concentrated a very high proportion of their investment in building and expanding their core networks and ensuring easy connectivity in each country. By this means, they have avoided the complexities and costs of developing in-country platforms, domestic market wallets and issuer/acquirer services. It is suggested that EPI should similarly focus initially on designing and building a basic core network (much as the ICS approach) leaving local processing to domestic commercial and interbank processors. This will reduce complexity, limit the risk of cost overruns, ensure continued domestic sovereignty as well as the retention of local payments assets, skills and resources.

4. IP Ownership. Sovereignty is not just about owning a scheme and brand. It is also about ownership of the underlying Intellectual Property (IP) related to the standards, network and service delivery components. All the major payments players and schemes own their IP as a fundamental policy. Ownership enables the construction of competitive Unique Selling Propositions (USPs), provides the agility and flexibility needed to implement rapid change and control release priorities. Although costly, IP ownership is a vital long-term enabler of a successful competitive scheme network development and delivery strategy.

5. Infrastructure Agnostic. As a result of the PSD/IFR and other EU legislation, the new EPI scheme will be obliged to decouple from its delivery service. An important CSF will be to ensure that any processing service avoids dependence and capture through a long-term contract by a single service supplier. Operational network control is a long-established policy of the super payments players, including the ICS and several EU regional and domestic schemes. Outsourcing network processing to a commercial provider has attractions for a low cost faster-to-market solution. However, the platforms and services of many of Europe’s payments processors are primarily designed to support domestic schemes. Inevitably, adaptation to accommodate a modern EPI scheme will involve design compromises. A Key Enabler is for EPI to identify a neutral processor owner and avoid supplier dependence.

6. Compelling Commercial Model. Over and above the strategic and sovereign objectives of the EPI initiative, the new scheme also needs a strong and compelling business case as a CSF to incentivise both issuers to migrate from domestic or ICS brands and acquirers to enable acceptance. Capped debit interchange will be an important ingredient in the EPI commercial model to deliver issuer benefits. However, even if interchange were to be reduced to zero by regulators, ICS scheme fees generate high revenues which enable strong issuer switching and brand retention marketing incentives. Therefore, EPI has an opportunity to undercut ICS scheme fees (which currently average 0.20%) with highly competitive rates at less than 0.05% provided development costs are contained.

7. Authorisation Processes. One of the most important design differences between SCTinst and cards payments is merchant use of a separate acquirer to issuer authorisation step for each card transaction. Single message architectures linked to Instant Payments are simpler, dematerialise batch clearing submission and enable real time settlement. However, card authorisation delivers significant value to consumers and merchants, not just for managing risk/reducing fraud, and supporting specialist sectors (such as the petroleum), but also by using pre-authorisation to revalidate stored cards on file for merchant initiated recurring payments. In addition, many merchants value the batch clearing submission process and few (if any) would welcome one-to-one transaction settlement. A Key Enabler would be to build a card scheme and network which offers both single and dual messaging.

8. Value Added Services (VAS). The major ICS offer a wide range of ‘in network VAS’ to merchants, acquirers and issuers to enable eCommerce, POS acceptance and risk management. These range from fraud monitoring, account updating/validation, recurring payments, chargeback processing, tokenisation and many more. Both schemes have invested substantially and offer 45/50 network embedded VAS, some of which have become essential services particularly for the issuing business. Despite their high cost, recognising the 6/7 core VAS features and focussing on their development will be an important Key Enabler for the success of the EPI scheme proposition if issuers are to be persuaded to switch brands.

9. Consumer Redress and Risk Management. Electronic ACH payments are a newcomer to POS and eCommerce payments and as a result have not been purpose-built to manage the unique fraud risks, counterparty risk and consumer redress requirements (including transaction repudiation) of day-to-day retail payments. It is proposed that any new European card scheme should have consumer redress processes embedded end to end, including frictionless refunds, chargebacks and product liability as vital application features. Similarly, for merchants and acquirers, the payments guarantee and merchant default monitoring are essential scheme components.

10. Minimum Viable Product (MVP). Finally, it is suggested that a primary success factor for EPI will be to develop a Minimum Viable Product (MVP) for the initial card scheme, design, build and delivery. The Phase 1 deliverables focus should be as card-centric as possible, avoid interference factors from applications not clearly aligned and which have potential to be a diversion from the development of the core card scheme. Ideally, the Phase 1 MVP should only deliver core central card network functionality.

The EPCA believes that whilst these 10 messages may seem like motherhood and apple pie, history tells us that many complex payments development projects rapidly suffer from uncontrollable “application scope explosion”. Designers often fail to appreciate the need for pragmatism and the simple clear vision and design attributes needed to ensure low risk and delivery on time and to budget.

EPI is in a unique position to design and deliver another World Class payments initiative but will only succeed with strong focussed management and an agile methodology which limits the scope of its strategic architecture and operating models for the new scheme and network.

The European Payments Consulting Association (EPCA) is a Pan EU network of independent payments consultants created in 1998 and have an aggregate turnover of €20m, over 500 clients and 80 payments consulting professionals. https://europeanpaymentadvisors.com