By Peter Jones, Chairman PSE Consulting

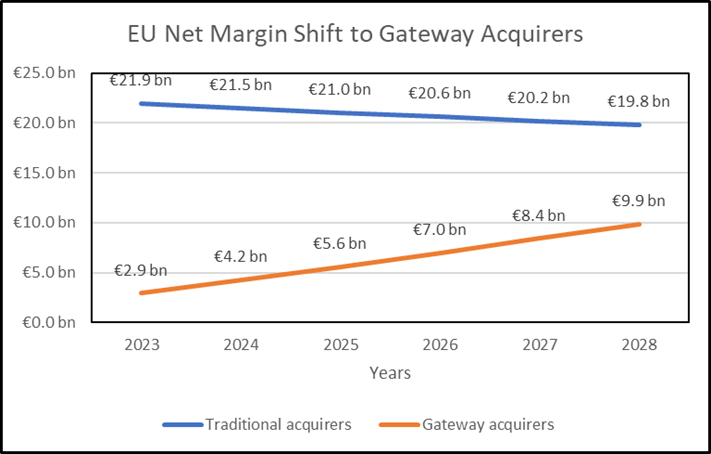

Who is sleeping well within EU acquiring banks and Fintech innovators? Who will be the winners and losers as a result of the increasingly dramatic shift of the EU payments acceptance margins to new entrants?

It is difficult to speculate on the early morning top of mind concerns amongst the captains of EU’s traditional acquiring businesses. But for many it’s trying to forget last night’s nightmare! Their once comfortable vision of promotion to a senior banking role has been devastated by market turmoil driven by the rapidly expanding technology gap between old style players and Fintech competitors.

10 years ago, payment gateway services were patronisingly perceived by banks as beneficial routing enablers and simple and profitable ISO partners but lacking the skills and capability to manage a full-on risk acquiring business. This has turned out to be a strategic misconception leading banks to fail to invest and become misaligned with merchant requirements.

In recent years intense gateway competition commoditised processing fees, forcing gateways to search for new value-added services. None were more attractive than on risk acquiring’s ability to quadruple revenues and enable delivery of a complete end to end payment service to merchants. Some initially entered into semi risk via Payfac deals with acquirers, enhanced their front ends to enable fast onboarding, leveraged their merchant support services and extended their back ends for merchant settlement. Many went further and invested heavily in technology and IP ownership, developing a smooth single integrated omnichannel architecture for both eCommerce and F2F. This was followed by direct card scheme membership, and the construction of a one stop single supplier offer which increasingly includes terminals and extensive VAS.

Europe’s traditional acquirers were slow to recognise the strategic threat from the evolving gateway acquirer technology driven model. Initially many continued to cash cow their enterprise and SMB merchant portfolios, particularly following the interchange regulations. Nearly all outsourced eCommerce gateway processing positioned in front of their legacy F2F acquiring platforms but continued to offer fragmented platforms, slow moving onboarding processes and variable service quality. A small number belatedly bought eCommerce gateway players and concluded ‘job done – we are now defended’.

How wrong they were! Suddenly the acquiring market dynamics changed post lockdown. The balance of persuasion shifted to the gateway acquirers’ proposition and product. Large enterprise merchants loved the modern, single supplier integrated end to end service offer with omnichannel and orchestration features. ISVs are delighted with fast onboarding. Many have been happy to pay higher fees for a much-improved service.

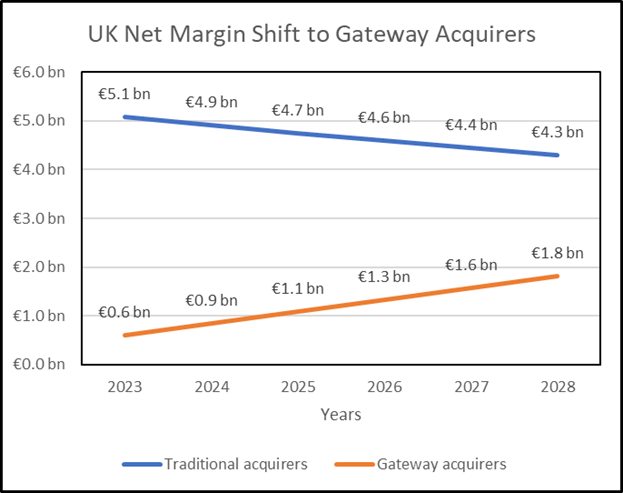

The gateway acquirer model is now severely impacting traditional UK acquirers. Many are struggling to retain large merchants at contract renewal time and see their SMB portfolios rapidly draining. There are few practical, proactive or defensive strategies available. Building and implementing a new acquiring technology platform, replicating the integrated omnichannel eCommerce and F2F features offered by market leaders such as Adyen and Checkout and smaller players such as Cashflows is a high risk, complex and costly development. Many have no option but to rapidly pull the ‘reduce fees lever’ and hope their merchant customers will not switch. But unfortunately, the ‘price handle’ has fallen off and depressed performance for many players as revenues plateau and profits stagnate. Increasingly, bank owners are considering JV technology partners to share assets and the cost of development, based on the carving out of their acquiring operations. Others are giving up, seeking to exit and the sale of their merchant portfolios.

Strategic EU buyers such as Worldline and Nexi have been primary beneficiaries of the traditional legacies rush to partner or sell with several EU deals in the past year. Private Equity appears to be waiting and watching. Should they capitalise on bargain traditional acquirer lower multiples, invest and hope that they can be turned around. Or should they invest in gateway acquirers who are now just breaking into profit.

So, legacy acquirers captain’s promotion prospects are fading. Nightmares continue as they struggle to build realistic strategies and business cases to sell to the Board. The future for the traditional acquirer is bleak. Some believe that orchestration platforms can revitalise their legacy front ends and deliver omnichannel. Add fast onboarding and extend value-added services and perhaps traditional players can shrink and hold on for a few more years. However, this is an unlikely outcome. The gateway acquirer model appears to be an unstoppable force and the likely target for investors funds.