As consumer and corporate payments move ever closer to low-cost real-time processing a strange UK anomaly exists. The nation continues to process its card payments to a 1970s model designed for paper.

There are many reasons why UK cards are locked in a processing time warp. The UK was first to market in the cards business. Early credit card processing copied the American manual model with voice authorisation codes entered into embossed paper draft voucher sets. Drafts were deposited at bank counters for onward transmission to processing centres to be punch card entered two days later.

As the 1970s progressed, authorisation was automated, but the batch draft flow continued. Then in the early 80s simple offline terminals downloaded electronic clearing drafts for central processing to avoid the high 7p telecoms costs per transaction. Gradually, more sophisticated terminals were installed generating online authorisation messages. So, by the mid-80s dual-message processing became the UK norm and continues almost unchanged today.

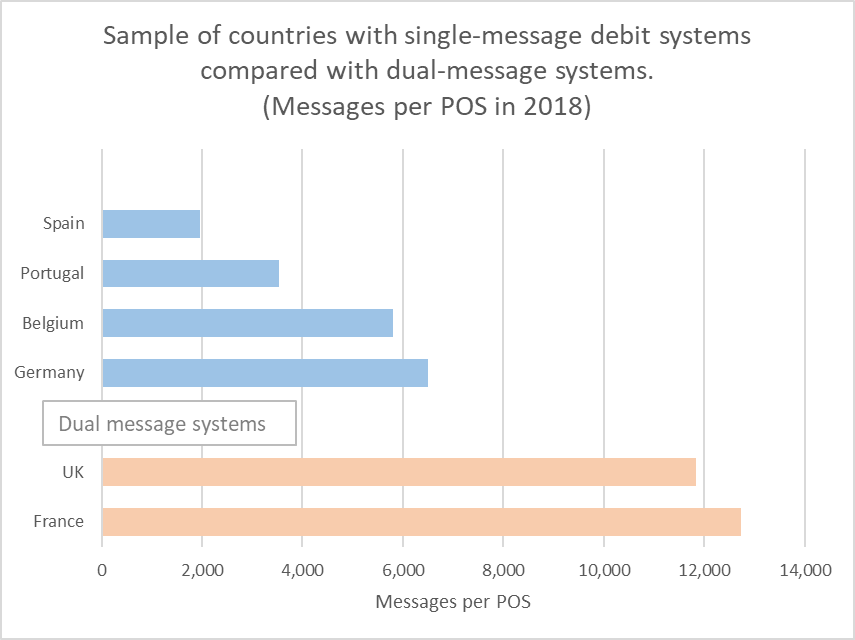

The European mainland took up cards in the early/mid 80s. However, EU interbank processors (besides France) made a fundamental advance by combining both authorisation and clearing into a single message, essentially updating the issuers, account at authorisation time and enabling overnight interbank settlement. Single-message processing became the norm for 8 of the current 9 EU domestic debit card EftPOS schemes (see chart for sample comparison).

Sadly, the UK missed a single message opportunity in the late 80s, when the National EftPOS’s project failed. Banks had no option, but to quickly build Switch debit using existing credit card two-message standards. A final missed chance was at the Switch conversion to Mastercard Maestro in the early 2000s. Again, unfortunately dual- message standards prevailed.

So the UK is locked into a complex batch two- message process with many steps performed by merchants and acquirers.

Acquirers can receive 200+ files from merchants, gateways and processors each day. The batch processing window is short, and end-of-day bottle necks are commonplace during peak periods. Authorisation matching, pre-submission processing, clearing record build is highly complex. Card schemes then need 36 hours to issuer/acquirer clear and settle multi-currency. Acquirers then have to handle exceptions and downgrades and reconcile. Not only is the batch process lengthy and error prone it also adds 25-30% to the costs of acquirer payment processing (estimated at 20bn transactions per annum). In addition, “Millennial” cardholders who demand instant account updates, have a 24-hour delay before their real balances are updated.

Contrast dual with single-message processing. Batch processes are eliminated, there is no managing of multiple files and processes, and errors are reduced. More importantly, new settlement propositions can be offered to merchants.

That’s not to say dual-messaging lacks advantages. The 36-hour clearing cycle provides a gap for fraud investigation. Single-message inflight interchange calculation is a potentially opaque process. Merchants do not want real-time transaction-by-transaction settlement and like the current simple end-of-day files and reconciliation. Most cardholders appear happy with their balance data and most do not realise it’s not quite up to date. However, these few benefits do not offset the major advantages that single messaging meets the market demand for real-time and reduces processing costs.

Unfortunately, it may now be too late for the UK to change. Adding a single message capability to ageing acquiring back-end processes will be very costly for the large traditional acquirers (gateway acquirers are better placed and many already handle dual and single). However, the strategic consequence of the UK cards business lacking fully online could be significant.

UK debit and credit card issuers may have to accept the the gradual displacement of cards by wallet-based Instant/PISP payment methods which, despite their lack of consumer redress, will be attractive to merchants because of their low cost.

So, the pseudo “paper chase” model will continue for many years with the UK falling behind the EU in payments efficency and productivity unless change is mandated by the regulators or card schemes.

By Peter Jones

PSE – London, UK