Peter Jones, Chairman, PSE Consulting

Over the past 10 years, Europe’s cards business has suffered a tidal wave of regulation. Not only have regulators remodelled the cards operational framework, they have also launched an ambitious vision to redesign the shape of ‘Europe’s payments business through regulatory innovation. But have regulatory product designers made a serious mistake in constructing their plan using simple ACH instruments to compete with the cards business?

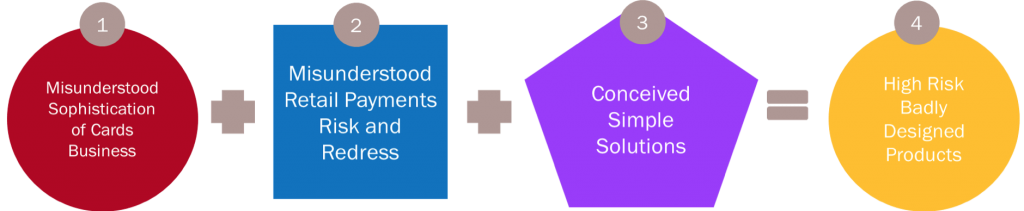

Some predict that the outcomes from regulatory innovation (instant particularly) may seriously damage Europe’s cards business. More importantly new products have potential to deliver a poor-quality high-risk service to Europe’s citizens and merchants, because regulators’ lack of detailed understanding of retail payments’ functionality and eCommerce.

So why have the regulators intervened in such a heavy-handed manner? To a degree Europe’s card business must take responsibility for damaging its image over the years. Both international and domestic card schemes had built walled garden rule books, operated mono-brand models, restricted membership and geographic operation. In addition, many leveraged their market dominance with high interchange and MSCs resulting in high costs to merchants. Merchant and regulatory criticism was often ignored and there was a collective misunderstanding of regulatory threats and intentions.

All these factors encouraged interventions by the regulators which has resulted in a concerted initiative to redesign the structure of Europe’s payments business to improve competitiveness.

Although their interventions were well intended, regulators and other stakeholders lacked the detailed knowledge to design totally new retail and eCommerce payment instruments. Central banks particularly focussed on reworking the simple ACH payment instruments they understood. This has resulted in a series of “copycat regulatory innovations” all based on the credit transfer (CT).

First the UK Treasury mandated banks to develop Faster Payments. This was followed by the EPC’s instant payment initiative, again based on the CT following the successful implementation of the SEPA Credit Transfer. The UK led again with Open Banking enabling third parties to initiate bank account CT payments. Similar concepts were embedded in the EC’s PSD2 regulations. The ECB is now building a new Pan EU instant payment infrastructure (TIPS), with a CT benchmark cost at fractions of a cent.

These copycat concepts have also encouraged Fintechs to develop new services leveraging the Instant payments and Open Banking platforms. Most Fintechs assume the foundation CT is fit for consumer use, secure and low-risk because of its strong regulatory backing.

But all is not well. Many are now questioning the regulators’ strategy. The focus on the CT may have been misguided. After all, the CT was designed 60 years ago to displace cash wages and enable business to business payments. It is simple, basic and featureless. A payment instrument frozen in time with little or no development or investment. It was never intended for use as a retail payments instrument. Contrast CT’s development with the massive investments in the card business over the same period. The simple paper and voice processes of the 1960s have been displaced by high-performance national and international authorisation clearing and settlement systems. Card product features have expanded, and more importantly consumer redress processes developed to enable refunds (particularly for eCommerce), chargebacks, fraud and product guarantees. Similarly, merchant KYC, risk assessment and monitoring processes are recognised as best in class and a benchmark model for identifying fraudulent accounts.

Superficially, instant and other CT based instruments make a compelling offer to consumers and merchants. It is skeletal design, very low cost, real-time push authorisation and P2P capabilities at first appear an attractive proposition. However, many do not realise the CT does not compare with cards. Refunds are not enabled, fraud not refunded and misdirected transactions potentially lost. In addition, the CT does not provide fraud monitoring, lacks transaction repudiation (chargebacks) and offers no product or service guarantees in the event of merchant bankruptcy.

The consequences of these functionality gaps are becoming clear in the UK which was first to market with its CT enabled Faster Payments service. In 2018 push fraud is accelerating to €400m per annum with consumer losses averaging €3k and businesses €25k. Only 4 out of 10 victims win redress and then often no more than 25% of the value lost. A high proportion of CT fraud reflects poor corporate account risk assessment and KYC at on-boarding time and a subsequent lack of fraud and risk monitoring. The good news is that UK’s Payment Services Regulator (PSR) has mandated payee name at authorisation time and fraud refunds where banks are clearly responsible. However, many card-like features are still missing including UK Consumer Credit Act guarantee. The UK’s experience today could soon be EU’s problem tomorrow as instant and other CT based services are rolled out.

So, what collateral damage will CT payments have on the cards business? There is no doubt very low costs will encourage merchant acceptance. Real-time account updating is attractive to millennial wallet and card holders. The SWISH P2P service in Sweden and equivalent offers in other markets are already very widely used and are impacting card volumes. In the pipeline are 30+ new entrant and Fintech payments concepts which will roll out over the next three years as well as new services from the international technology providers. There are clear indications that the cards business must expect displacement to accelerate.

However, the cards sector is struggling to build a counter strategy and is on the back-foot, partly as a result of the IFR (and the upcoming review) and partly because many banks’ ACH silos have developed CT payment offers. In addition, the collective will to lobby key stakeholders has also been weakened as a result of regulators’ determination to change the EU’s payments landscape.

To delay a cards business fightback would be foolhardy. Some CT missing features are already being addressed in several markets (ACH fraud monitoring particularly) and more will follow. At a minimum, the deficiencies in the regulator’s strategies should be forcefully communicated with a focus on eCommerce. In addition, the potential risks associated in using the CT needs to be clearly communicated to consumers and merchants. Also, card issuers should consider developing their own low-cost instant card offer delivered within the scheme redress wrapper to compete with the instant CT.

Finally, failure to resell the massive benefits of card enabled payments to citizens and corporates could result in a steady decline of the cards business over the next ten years.