Peter Jones, Chairman, PSE Consulting

Proposition

Instant Credit Transfer (ICT) real time payments are becoming a real concern to cards business strategists. Some predict a perfect storm by 2022. By then the second IFR review will have been completed; there are rumours that consumer debit interchange may fall to zero, and credit to 0.1%; commercial cards (including VANS) interchange considered in-scope; scheme fees may be under investigation; and Forex margins all possible capped. All this, just when the ICT begins to gain traction. It’s a worrying vision. The cards business increasingly fears for its future and lacks a sense of direction.

Instant Credit Transfers’ Strengths

Some cards optimists argue that the ICT is a paper tiger and that consumers are unlikely to change their cards payments behaviour. However, it would be wrong to dismiss the strength of the ICT proposition:

- For consumers it offers several advantages over cards. It’s a simple, well known payment method, with easy push authorisation. Transactions are real-time, balances are immediately updated, improving control – whereas cards are updated 12/24 hours later. ICTs also enable P2P payments, an offer cards struggle to match.

- For merchants it is also real-time, needs no end of day batch submission, offers improved cash flow, settlement is final and no complex chargebacks and issues with declines.

Instant Credit Transfers’ Weaknesses

The most obvious weakness, and of great concern to consumer lobbies, is its lack of consumer redress. Key gaps include no chargeback rights, no repudiation, no disclosure of fraudulent account ownership, no names of misdirected account recipients.

It is common knowledge that the credit transfer was never designed for retail payments. The product has been developed within the ACH silo and as a result merchants are offered one to one transaction settlement. This is a feature nearly all (besides the very small) reject as too complex to control. Also, a major omission is lack of a refund process for returned goods (a must-have for online). In addition, transaction and account fraud monitoring is weak and KYC and AML checks for new account openings are often ineffective.

The UK has been one of the first to market with an I CT service. After 8 years evidence of its limitations grows with over €250m in fraud in 2017 of which only 25% has been recovered by consumers and businesses.

Despite these issues, the most compelling ICT advantage to consumers and merchants is its immediacy, a key feature missing today in the cards world. Could an Instant Card product be developed, what would be the user offer, its main features and benefits?

Components of an Instant Cards Proposition

In deciding the nature of a new Instant Cards offer, there are a number of key design criteria that should be applied:

- First the offer must leverage the card scheme redress wrapper and convince consumers that use of the ICT is higher risk.

- Second the card rails must become real-time across all stakeholders: merchants, gateways, acquirers and issuers

- Third acceptance costs must be very low and use a different model to cards.

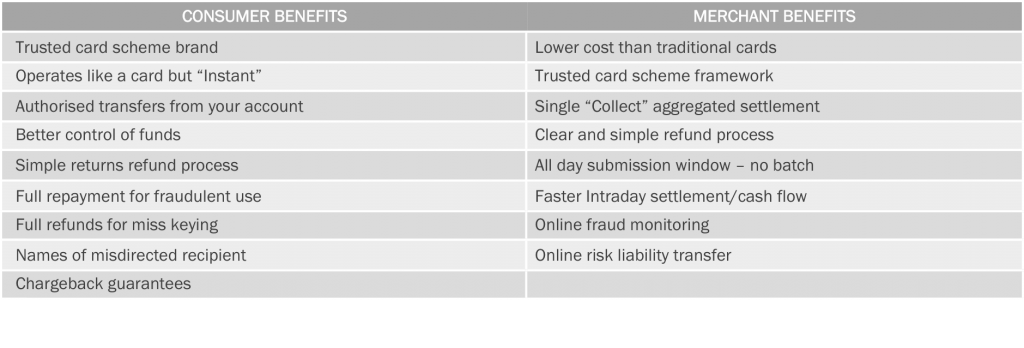

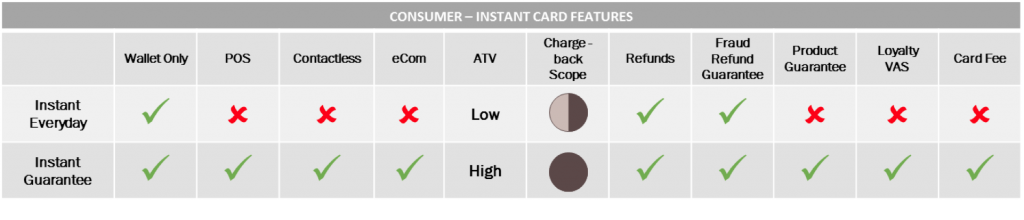

Using these design criteria, a potential proposition can be developed. For the consumer the most compelling consumer features are likely to be refunds, no liability for fraud and a chargeback process to repudiate payment. For the merchant benefits should include: lower cost than cards, all day submission, intraday settlement and online risk transfer. The overarching message to consumers is ‘Why take risks with alternative payments when only cards guarantee your money back?’ Example of an Instant Card proposition benefits are summarised overleaf.

Instant Cards Product

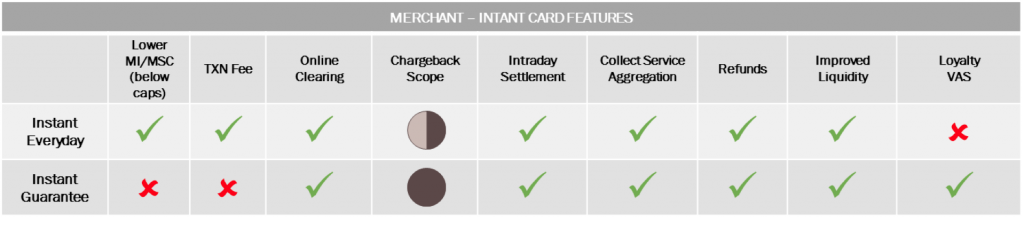

Both products translate into the merchant product described in the next table. Instant Everyday has a transaction fee with no/low MIF, and simplified chargebacks. Instant Guarantee is tariffed as capped debit with full chargebacks. Both products could be aggregated by an acquirer with traditional cards/APMs in a collect service that would simplify settlement and reconsolidation.

Feasibility

However, developing an Instant Card product has a significant dependency. The cards rails have to migrate to real time (although many argue this is a strategic “must do” migration from current semi-batch). Most domestic and international card schemes already offer Single Message (SMS) processing so the costs of network change will be relatively modest. However, traditional acquirers and some gateways and merchants will require development projects to add the SMS functionality required to enable the Instant Card to offer to be delivered. The good news is the SMS migration business case needs a revenue generating product and Instant Card has potential to help service this investment.

Conclusions

So, could a credible Instant Card offer be developed that would match the immediacy of the ICT? Yes, particularly if the proposition exploits the weaknesses and gaps in the vanilla ICT and is delivered within the cards redress wrapper. However, developing and launching Instant Cards will not be easy. The cards business has to collectively agree to compete and invest to deliver a real-time service. Of equal importance, will be a campaign to communicate the benefits and lower risks that cards deliver to Citizen Europe.