Much has been written about the impacts of COVID19 on cash displacement and consumers rapid migration to contactless card payments. Some commentators have raised the fear of unbanked cash disenfranchisement and cash deserts as contactless sweeps the EU. Merchant Associations have similarly pushed back claiming acquirers are benefiting from increased volumes and that members costs have increased significantly.

Historically, merchants (and some academics) claimed that cash is the most efficient form of payment. Several produced cost studies that suggest cash has lower costs than cards . Card schemes and acquirers were reluctant to challenge with a Merchant Cost Benefit case for cards. Most focused on promoting the consumer convenience advantages in their pitches to the SME community. Few have thoroughly researched end to end costs.

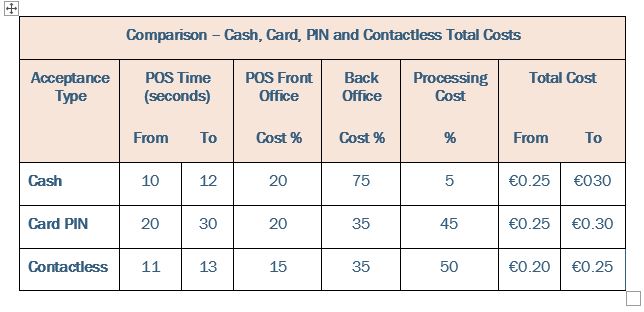

Based on research conducted by PSE, there are several reasons why cards appear more costly than cash. One is that the core processing times at the POS are significantly higher for Pinned transactions at between 25-30 seconds when compared with simple cash at 11-12 seconds. Translate these times into operator costs and the immediate cards vs cash cost benefits business case begins to look shaky, particularly when combined with card processing fees and POS terminal rental.

However, when the total end to end costs of cash acceptance are calculated, the cost benefit case for cards begins to change. Cash processing for all merchants turns out to be very costly. Cash acceptance costs increase significantly when back office handling is added. Cash boxes need to be collected intraday and end of day, reconciled, change errors identified and staff fraud monitored. Cash then needs to be securely stored and delivered to the bank. In addition, cash carries a very high security overhead. Cameras, safes and locks need to be purchased, installed and maintained and insurance paid. Many SMEs also factor in the impact of regular till snatches, theft and burglary. Thus, for medium and smaller merchants, total costs of cash can be between €0.25-€0.30 per transaction.

Cards, on the other hand have much lower back office costs. End of day reconciliation is easy, settlement simpler, fraud lower and costly investment in security capex modest. However, cards automation comes at a cost. Total Pinned card costs can also be between €0.25-€0.30 of which acquirer card processing and terminal fees often represent 50%. So, for traditional card acceptance, the cost benefit case for cards over cash is marginal.

However, with the introduction of contactless payments, the cash/cards cost benefit model has changed. Contactless dematerialised PIN entry (and also in some markets slow authorisation) and significantly reduced card processing times at the POS by over 12 seconds, lowering traditional cards acceptance costs over cash by 10-15%.

But that’s not the only benefit of contactless. Covid19 contactless migration (and the higher card scheme limits) has altered the transaction mix for SMEs. In many countries 60% cards and 40% cash has accelerated to 95% cards and 5% cash. As a result, the cash vs card business case cost dynamics have changed. Many of the high fixed costs of cash remain but with much lower volumes, end to end costs have increased. Card costs on the other hand have declined as higher volumes are processed through the POS terminal.

We estimate the costs of contactless cards acceptance has fallen by a further 5-7.5% as a result of volume mix changes. Now the total cost benefit of contactless cards over cash can be as high as 15%. Also, as a result of Covid cash costs are now close to 2.5% of the transaction value. Contactless can be as low as 1.9%.

So, how might the contactless cost benefits be translated into savings for the typical SME merchant? Less cash has improved POS processing and reduced operator effort and time. Add much reduced daily back office cash handling, fewer bank visits and cash recycling and there is a potential saving of 3 hours per day. For medium sized merchants this could generate possible annual savings of €5000-7000. For larger convenience stores with turnover of €5m-7m, potential savings could be as high as €10,000 – €15,000 per annum.

In Covid times, merchants have good reason to object to any increase in the cost of payments processing. However, the merchant community should recognise and welcome the improvement in efficiency that contactless delivers.